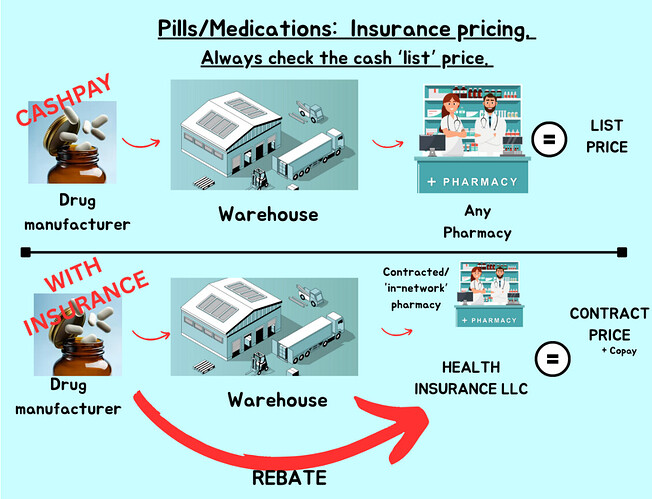

I don’t think so. My understanding is that the rebate has to go via a third party to be legal.

If the rebate goes directly to the insurance company it’s just a negotiated price and then that is the price the patient pays.

If the rebate goes via a third party then the patient pays the price before the rebate yet the insurance company can still get a kick-back (not the full rebate in practice) from the third party.

In practice the third party is an organisation set up to pool the very limited power of multiple small insurers when negotiating with the big guys; the pharmacies and the manufacturers but mainly the pharmacies since they are the biggest (there are fewer major pharmacies than there are major drug manufacturers). As the health insurance industry consolidates the third parties are likely to get eliminated but I don’t think that has happened yet.

A side effect is the Medicare price; Medicare cannot negotiate (this may change), so Medicare pays the “retail” price. At one time the retail price was the price insurance paid but without the rebate. From what I’ve read of the Medicare rules it seems that might have changed; there seemed to be stuff in there about using prices post-rebate but maybe that only applies to the Part D insurers.

The small insurance companies do not seem to go for direct negotiation with the pharmacies; my pre-Medicare ACA insurance company, moda, did not tell me about any “in network” benefits. On the other hand I would expect HMOs to strictly use specific pharmacies; that’s the way HMOs work.

Now I’m on Medicare there seems to be a slight cost advantage is going to a “preferred” pharmacy (this is with Cigna this year). I’m moving to UNH next year so I don’t know if that will still be true. There does seem to be an advantage, though still not a major deal, going to mail-order supplies. I’m going to suck-it-and-see next year.

On the private side (i.e. buy-it-yourself) the big deal, the really big deal, is that the “contract price” (using the terminology from the powerpoint) is itself massively inflated for many things (famously for insulin) so this makes it unaffordable for regular human beings without insurance. People with insurance pay the “contract price” until they hit their deductible/copay/out-of-pocket-max/mole/whatever then pay much much less, if anything.

The thing here is that the “contract price” is massively inflated but only for some things. Lots of medications, while the price might be somewhat inflated, aren’t that inflated. Statins, metformin, etc. Others are, insulin (big mistake there), GLP-1 agonists, things that very few patients need.

This means that the insurance company can swallow the price inflation because most of their customers don’t need the things with the inflated prices. But who inflates it? Who profits? Follow the money; the pharmacies because they are the big guys, they negotiate prices directly with the manufacturer.

The interpolation of “warehouse” in the powerpoint is also somewhat weird. What is this “warehouse”. Mostly distribution is controlled by the manufacturer but for the major pharmacies they are the warehouse, the distributor. Indeed companies like Walmart are just as much distributors as retailers. I referred to “third parties” above, but they aren’t involved in distribution; they are negotiators who can get a deal; so far as I can tell they don’t do anything else.